Bona Fide Redundancy

Free Discussion With Employment Experts. Find Out If Your Redundancy Was Lawful.

Employment Termination Payments Atotaxrates Info

A termination type includes all other termination reasons such as resignation.

Bona fide redundancy. This table shows the limit set for genuine redundancy and early retirement scheme payments from 1 July 2007 onwards. The decision led to the termination of the employees. Redundancy payments are then provided to employees who are retrenched.

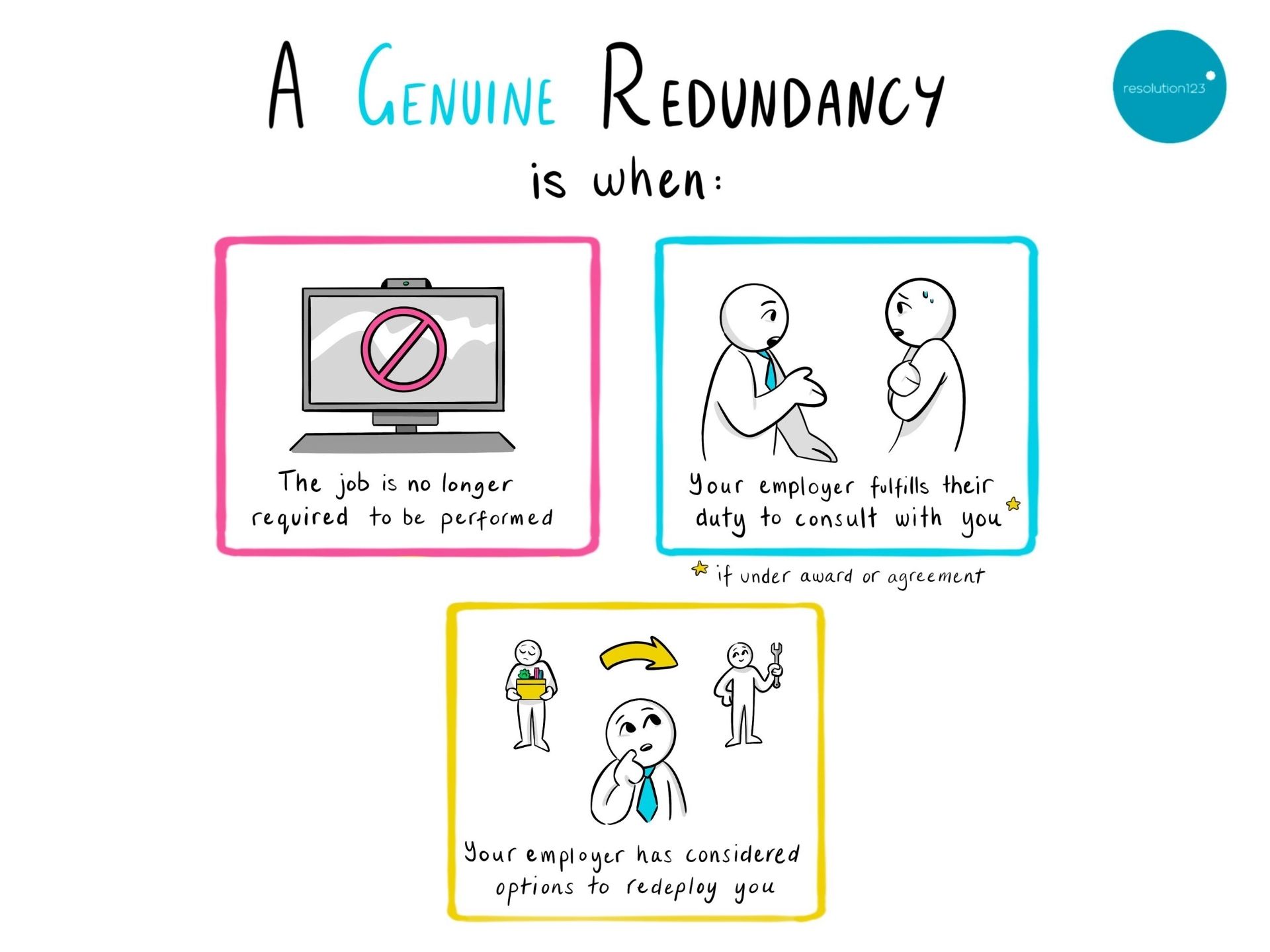

32 32 For a position to be a bona fide redundancy it must cease to exist and there can be no plans to fill the position in the foreseeable future. If you are offered redeployment or other job opportunities within the company and dont accept them you need to check with your. Tax-free part of genuine redundancy and early retirement scheme payments.

Bona fide redundancy and approved early retirement scheme payments in excess of a tax free amount the tax free amount is indexed annually certain payments following the death of an employee. A bona fide redundancy occurs when. A redundancy type includes bona fide redundancy approved early retirement or invalidity payments.

To find out if you are required to pay redundancy pay check the National Employment Standards and your relevant industrial instrument eg. In support of that submission Sensis relied upon the holding in Dibb v Commission for Taxation 2004 136 FCR 388 at 43-44. A dismissal is a case of genuine redundancy when.

A retrenchment payment which results from a bona fide redundancy receives favourable taxation treatment by the Australian Taxation Office. If a transfer of employment has not taken place an employee may be entitled to redundancy. The decision is not due to the ordinary and customary.

The employer has complied with any. A termination type includes all other termination reasons such as resignation. Redundancy Redundancy and redundancy payments Redundancy is when an employer reduces their workforce because a job or jobs are no longer needed.

Demonstration of bona fide redundancies is therefore critical to the process. Example 1 Bob is to be dismissed because there is no longer enough work to keep him onYou are required as Bobs employer to pay. The taxpayers employment had been terminated because her employer company.

Tax-free part of bona fide redundancy payments and approved early retirement scheme payments limits for earlier years up until 30 June 2007. An unfair dismissal case cannot be made if. The obligation on an employer to consult about redundancy only arises when a modern award or enterprise agreement applies to an employee and that modern award or enterprise agreement contains requirements which they often do to consult about redundancy.

Genuine redundancy or early retirement scheme payments The income tax-free portion of genuine redundancy payments previously known as bona fide redundancy payments or early retirement scheme payments previously known as approved early retirement scheme payments is exempt. Genuine redundancy payments previously known as bona fide redundancy payments and early retirement scheme payments previously known as approved early retirement scheme payments A payment arising from the termination of employment may constitute either a genuine redundancy payment under section 83-175 of the ITAA or an early retirement scheme payment under section 83. As discussed above Dibb was an appeal concerning the revenue treatment of a redundancy payment and whether the payment met the statutory test of being a bona fide redundancy payment under income tax legislation.

The Fair Work Commission has developed a body of case law about what is meant by the term genuine redundancy which of course is a complete jurisdictional defence to an application for an unfair dismissal remedy if made out by an employer. With a bona fide opportunity to influence the decision maker. An unfair dismissal application cannot be made if the dismissal was a case of genuine redundancy.

To report the termination payment type you need to create a termination payroll category for each amount that will be included as part of a Lump Sum Payment A amount. A redundancy type includes bona fide redundancy approved early retirement or invalidity payments. Find Out If Your Redundancy Was Lawful.

The job of an employee ceases to exist. If a situation of bona fide redundancy exists only that part of the payment which is additional to what the taxpayer would otherwise have received as a result of voluntary retirement is a concessional component. The employer no longer requires the persons job to be performed by anyone because of changes in the operational requirements of the employers enterprise AND.

If an employee questions their termination of employment they may lodge an unfair dismissal claim. 29 rows Information relating to the tax free limits of genuine bona fide redundancy. Contract of employment workplace policy that provides different redundancy pay amounts.

If there is an applicable industrial instrument or contractual arrangement eg. Award or enterprise agreement. The Federal Court has also had much to say about what is meant by the expression bona.

The amount of an ETP that is liable to payroll tax is the amount that would be assessable income for income tax purposes of the employee. Employment and the termination is not on account of. Ad Sham Redundancy Case.

The AAT has held that an eligible termination payment ETP made to the taxpayer Mrs Long who was both an employee and director of the employer company was a bona fide redundancy payment for the purposes of s 27F of ITAA 1936 by reason of her dismissal from employment. Ad Sham Redundancy Case. Free Discussion With Employment Experts.

To report the termination payment type you need to create a termination payroll category for each amount that will be included as part of a Lump Sum Payment A amount.

The Value Of A Genuine Redundancy Money Management

Redundancy And Unfair Dismissal Unfair Dismissal Lawyers

Employment Termination Payments Atotaxrates Info

Genuine Redundancy Or Unfair Dismissal Owen Hodge Lawyers

Illegal Redundancy In Nsw Get An Impartial Assessment

Big Change Benefits Protect Severance Members Protect

What Processes Should A Company Follow Before Making A Redundancy Payment To You Employment Law Online

Everything You Need To Know About Redundancy Mybusiness

Genuine Redundancy Employer Requirements Adams Wilson Lawyers

Genuine And Legitimate Redundancy Can Be Unfair Dismissal Fair Work Legal Advice

What Is A Genuine Redundancy In Australia Fair Work Legal Advice

What Is A Bona Fide Redundancy Fair Work Legal Advice

Genuine Redundancy Go To Court Lawyers Australia

Considering Redundancies Key Legal Requirements To Ensure A Genuine Redundancy

Genuine Redundancy And The Importance Of Consultation

I Ve Been Made Redundant What Are My Rights Resolution123

The Essential Guide To Redundancy National Retail Association